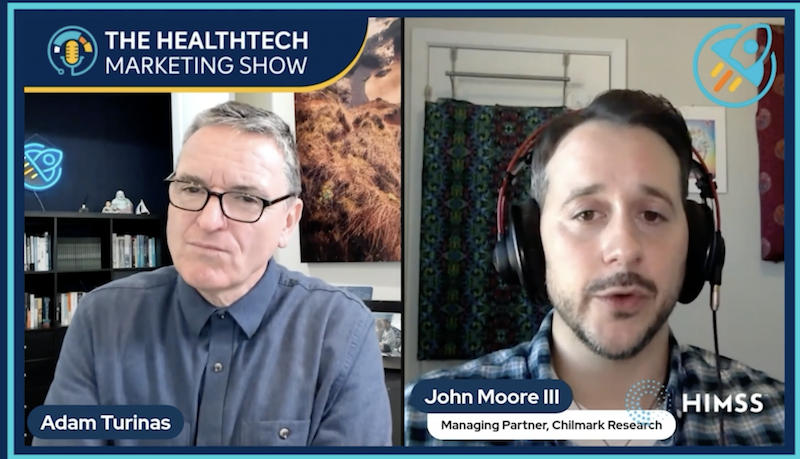

Industry analysts play a vital role in healthcare technology, helping buyers navigate an increasingly complex vendor landscape. In this episode of the Healthtech Marketing Show, John Moore III, Managing Partner of Chilmark Research, lends his perspective as a veteran analyst to elucidate the value firms like his provide. Read on for John’s insights on the role of healthtech analysts.

About Chilmark Research and John Moore III

John’s journey into healthcare began with plans for a PhD developing psychiatric medications before pivoting into analysis. After a stint as a health tech entrepreneur, he joined his father’s firm, Chilmark Research, full-time in 2013, rising to Managing Partner. As John explains, Chilmark focuses on technologies that improve patient and provider healthcare delivery. They distill confusing vendor marketing to cut straight to true differentiation.

Analyst Firms and their Role in Healthcare IT

Firms like Chilmark, Klas Research, and Gartner dominate healthcare IT analysis. As John describes, each carves out a niche based on the services offered. For Chilmark, that means delivering highly detailed technology assessments syndicated through reports. They also provide custom consulting around market positioning and messaging. Underlying their work is a commitment to objective analysis, helping buyers navigate strategic decisions rather than promoting any specific vendor.

Ensuring Analysts Provide Unbiased Perspectives

Given industry skepticism of pay-for-play dynamics, how does Chilmark ensure impartiality? As John explains, they don’t charge for inclusion in reports; they only charge for purchasing the end research. While ongoing vendor relationships facilitate information access, analysts ultimately independently evaluate market direction and vendor differentiation. Some reports see certain vendors upset over depictions, but Chilmark refuses to allow editorial influence. Still, even disappointed vendors often leverage assessments to realign strategies, demonstrating analyst impact.

Current State of Healthcare Provider Buying

While data shows the health system’s financial outlook is improving, community and rural providers struggle to balance lower margins. This bifurcation sees large, innovative systems pursuing leading-edge tools, enjoying strong demand and vendor attention. Smaller players battle frugally upgrading infrastructure. Still, exciting technologies exist, helping address budget challenges through optimizing workflows and resources. Ultimately, all vendors must validate investments delivering defined impacts, not just shiny new capabilities.

Determining ROI for Healthcare Technologies

Calculating ROI has plagued health tech adoption since the HITECH act. Financial imperatives clash with care’s moral dimensions across measures like improved patient outcomes. Chilmark targets this issue via an industry initiative creating ROI assessment standards. Much as GAAP provides accounting consistency, healthcare needs cross-cutting means measuring performance. This could overcome buyer skepticism, frequently hindering investment.

Emerging Technologies like AI and Real-world Data/Evidence

Despite hype, AI adoption remains in its early days, given lingering concerns around transparency and liability. That said, opportunities exist to streamline operations and workflows. As John explains, AI improves exponentially with human augmentation, outperforming alone. Beyond AI, experts see advances in leveraging real-world data to improve life science and care delivery outcomes. Chilmark’s coverage highlights rapid evolution across analytics, population health, and data infrastructure.

The Importance of Vision and Clear Messaging for Healthtech Companies

John points to getting distracted by buzzwords when asked what mistakes health tech vendors make. Buyers need substance grounded in examples of customer deployments and a cogent vision forward. How does your organization address emerging needs through product evolution? Analysts gauge this strategic alignment, separating transient players from more durable enterprises and meriting recommendations. Don’t just echo the latest hype. Plot a course improving patient and provider outcomes over time backed by evidence.

Building Relationships and Trust with Analysts

Maintaining executive-level relationships helps analysts keep tabs on company directions. Given frequent personnel changes, identifying stable points of contact proves vital. Honesty and transparency matter, too, as Chilmark’s fact-checking processes allow vendor input exclusively regarding accuracy. Let your organization’s actual momentum shine through. Endeavor to educate analysts on capabilities and roadmaps rather than sticking to rehearsed pitches. Consider analysts as collaborators in fairly assessing market landscapes.

Common Mistakes Companies Make in Working with Analysts

What frustrates Chilmark? Vendors are requesting the exclusion of relevant details, especially regarding acquisitions. Buyers monitor markets closely, demanding disclosure, not downplaying crucial context. Short-term image management distracts from actual standing. Does hiding basic facts help buyers assess solutions fairly? Such self-defeating secrecy damages analysts’ trust and vendor credibility alike.

Analyst Perspectives on Patient Engagement Solutions

Wrapping up, John highlighted patient engagement as an area primed for new attention, given post-pandemic strategic realignment towards consumer-centric models. While past efforts have often proved clumsy, advancing capabilities offer routes that improve access and satisfaction. Training careful focus here promises to enhance competitive positioning for forward-thinking providers via loyal, satisfied patient populations.

Here are Ten Tips for Marketers on How to Work Effectively with Industry Analysts

- Build long-term, transparent relationships. Maintain open communications with the same contacts over time rather than sporadic engagements.

- Clearly communicate your product vision and roadmap. Analysts evaluate future positioning as much as current capabilities.

- Share substantive evidence of customer outcomes. Avoid superficial marketing speak and hype.

- Accept analyst independence. They serve industry stakeholders, not your sales agenda.

- Allow fact-checking but not editorial control. Ensure accuracy, but don’t dampen candor.

- Consider custom consulting to convey specialized insights to customers. Aligned messaging and market positioning carry weight.

- Don’t overly fixate on press releases and reports. Ongoing analyst conversations often prove more impactful.

- Set internal expectations correctly regarding inclusion and evaluation criteria. Paying does not guarantee positions.

- Synthesize analyst feedback at the leadership level to adjust strategies, not just inform sales.

- Appreciate that analysts’ buyer-centric perspective differs from vendor vantage points. Their outside-in view balances your inside-out view.

Cultivating strong analyst relationships reduces marketplace confusion and promotes stakeholder alignment. Technology suppliers gain invaluable external validation by accepting analysts as impartial industry advisors rather than marketing vehicles, aiding commercial success.

If you liked this post and want to learn more…

- Check out more posts like this in the Healthtech MarketingLearning Center. It is chock-full of articles, use cases, how-to’s, and ideas to get you started on your ABM journey.

- Follow me or connect with me on LinkedIn. I publish videos and articles on ABM and healthtech marketing.

- Buy Total Customer Growth: Our book on how to win and grow customers for life with ABM and ABX.

- Work with me directly. Let’s book a growth session and we can explore ways you can improve your marketing using the latest techniques in account-based marketing.